Content

The higher a company’s higher fixed-charge coverage ratio, the more capable it is of paying its fixed costs using its earnings. Fixed charges are monthly fees you incur no matter how much power you consume. Increasingly, utilities are attempting to restructure electricity bills so that more of each bill is made up of these charges.

Realization of the Brazil-nut effect in charged colloids without … – pnas.org

Realization of the Brazil-nut effect in charged colloids without ….

Posted: Fri, 24 Feb 2023 18:27:50 GMT [source]

The fixed charge coverage ratio can also be used to compare companies within the same industry. The fixed charge coverage ratio shows how well a business can pay its fixed expenses, including mandatory debt payments and interest. One of the main drawbacks of the fixed charge coverage ratio is that it does not take into account a company’s working capital.

How to improve your FCCR

There are two kinds of https://intuit-payroll.org/, fixed charge, and floating charge. The former is a charge on the real asset of the company that is identifiable and ascertained when the charge is created. Conversely, the latter is slightly different, which is created over the the assets circulatory in nature, i.e. the charge is not attached to any definite property.

- Beyond that, when storms cause damage, our lines need to be repaired or replaced.

- The fixed-charge coverage ratio indicates a firm’s capacity to satisfy fixed charges, such as debt payments, insurance premiums, and equipment leases.

- Refinancing your existing debts into a lower interest rate can lower your interest payments and thus improve your FCCR.

- The Fixed Charge Coverage Ratio measures if a company’s cash flows are sufficient to cover its interest expense, mandatory debt repayment, and lease expenses.

- This cable doesn’t require as much maintenance but it is typically more expensive to install and more difficult and time consuming to locate problems and restore outages.

- Previously, NIPSCO filed for approval in October 2015 to raise their monthly fixed charge from $11 to $20.

He was voluble in his declarations that they would “put the screws” to Ollie on the charge of perjury. One Air Force official said that with enough time and more money, the EOTS could be fixed. Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

NIX THE FIX! Say NO to higher monthly fixed charges!

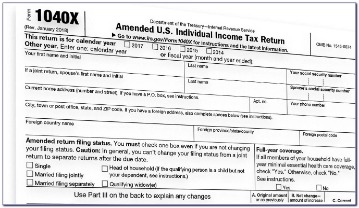

The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The FCCR doesn’t consider rapid changes in the amount of capital for new and growing companies. The formula also doesn’t consider the effects of funds taken out of earnings to pay an owner’s draw or pay dividends to investors. These events affect the ratio inputs and can give a misleading conclusion unless other metrics are also considered. A fixed charge is a recurring and predictable expense incurred by a firm.

The times interest earned ratio is also a measurement of a company’s ability to meet its obligations. However, it focuses solely on debt obligations, whereas the FCCR takes into account all fixed charges. That means Company B’s earnings before interest and taxes are 1.75 times higher than its fixed expenses. While its FCCR isn’t as high as Company A’s, it’s still above the typical 1.2 required by many lenders.

How Can Company Management Use the Fixed Charge Coverage Ratio?

A way of measuring your company’s ability to meet these fixed charges is the fixed charge coverage ratio , an expanded but more conservative version of the times interest earned ratio. Another financial metric often compared with the fixed-charge coverage ratio is the debt service coverage ratio, which is another important indicator of a company’s debt-to-capital-structure proportion. The fixed-charge coverage ratio measures a firm’s ability to cover its fixed charges, such as debt payments, interest expense, and equipment lease expense. It shows how well a company’s earnings can cover its fixed expenses. Banks will often look at this ratio when evaluating whether to lend money to a business.

Notably rooftop Fixed Charge, Fixed Charges ), Indiana’s electric utilities are seeking to increase fixed monthly charges on customers’ bills. Gulf Power withdraws plans for fixed-charge hike in Florida– This PV Magazine article reports on a Florida electric utility’s attempt to tack a bigger fixed charge onto its customers’ bills. The attempt, which would have increased the average monthly electric bill by $50, was thwarted after thousands of customers intervened at the Florida Public Service Commission. He fixed charges for checked-in reservations are placed on the invoice as of the entry date and all subsequent days of stay.